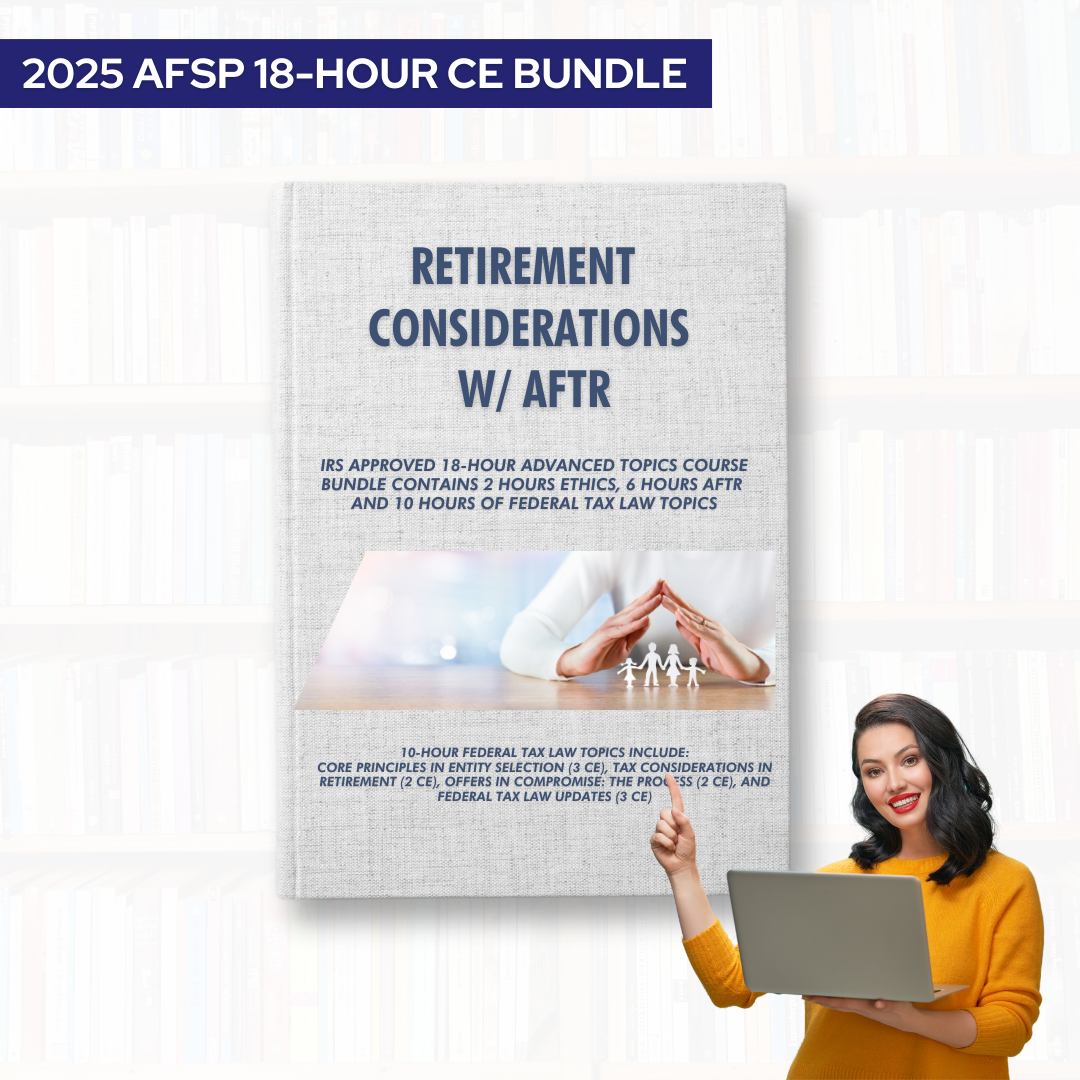

2025 AFSP 18-Hour CE Bundle- Retirement Considerations w/ AFTR

Learning Objectives:

- Assess tax implications and strategies for retirement planning, incorporating changes from the SECURE Act and other legislative updates, to optimize retirement savings and income tax outcomes.

- Learn advanced techniques for preparing and submitting an Offer in Compromise application, including the necessary forms, documentation requirements, and strategies for presenting a compelling case to the IRS.

- Gain a thorough understanding of recent changes to federal tax laws for tax season 2025 and how they impact individual and business tax returns.

- Analyze the ethical standards and responsibilities imposed on tax practitioners under Circular 230, including duties to clients and the IRS.

- Understand the annual inflation adjustments made by the IRS, including changes to federal income tax brackets, the standard deduction, and personal exemption amounts.

- Explore the impact of current tax laws and regulations, including recent reforms like the Tax Cuts and Jobs Act (TCJA), on entity selection strategies. Understand changes in corporate tax rates, pass-through deductions, depreciation rules, and other relevant provisions affecting business entities.

Our 18-hour AFSP tax course bundle contains 2 hours of ethics, 6-hour AFTR and 10 hours federal tax law topics. Our 10-Hour federal tax law topics includes:

Estate Planning vs Tax Planning (3 CE), Retirement (2 CE), Offers in Compromise: The Process (2 CE), Tax Law Updates (3 CE)

- Phone: 877-425-7873

- Email: info@suretaxsoftware.com

- Hours of Operation: 08:00 AM to 05:00 PM

error: Content is protected !!